tax saving tips for high income earners uk

The principal amount repaid in the current financial year is included under section 80C offering a deduction up to Rs. You make contributions with after-tax dollars but the money can grow tax-free and withdrawals up to the amount of premiums paid are not taxed.

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips As I P Roth Ira Finance Wealth Building

Sell Inherited Real Estate.

. Hold investments in a discretionary family trust for tax-effective income distribution. Last week I wrote a blog post about how the needs of high-income earners are very similar to the needs of the rest of the population and in. Perhaps the best technique of diminishing taxes for high income earners is by method for contributor prompted reserves since it has a capability of enabling you to exploit present and future year commitments and deduct them all in the present year.

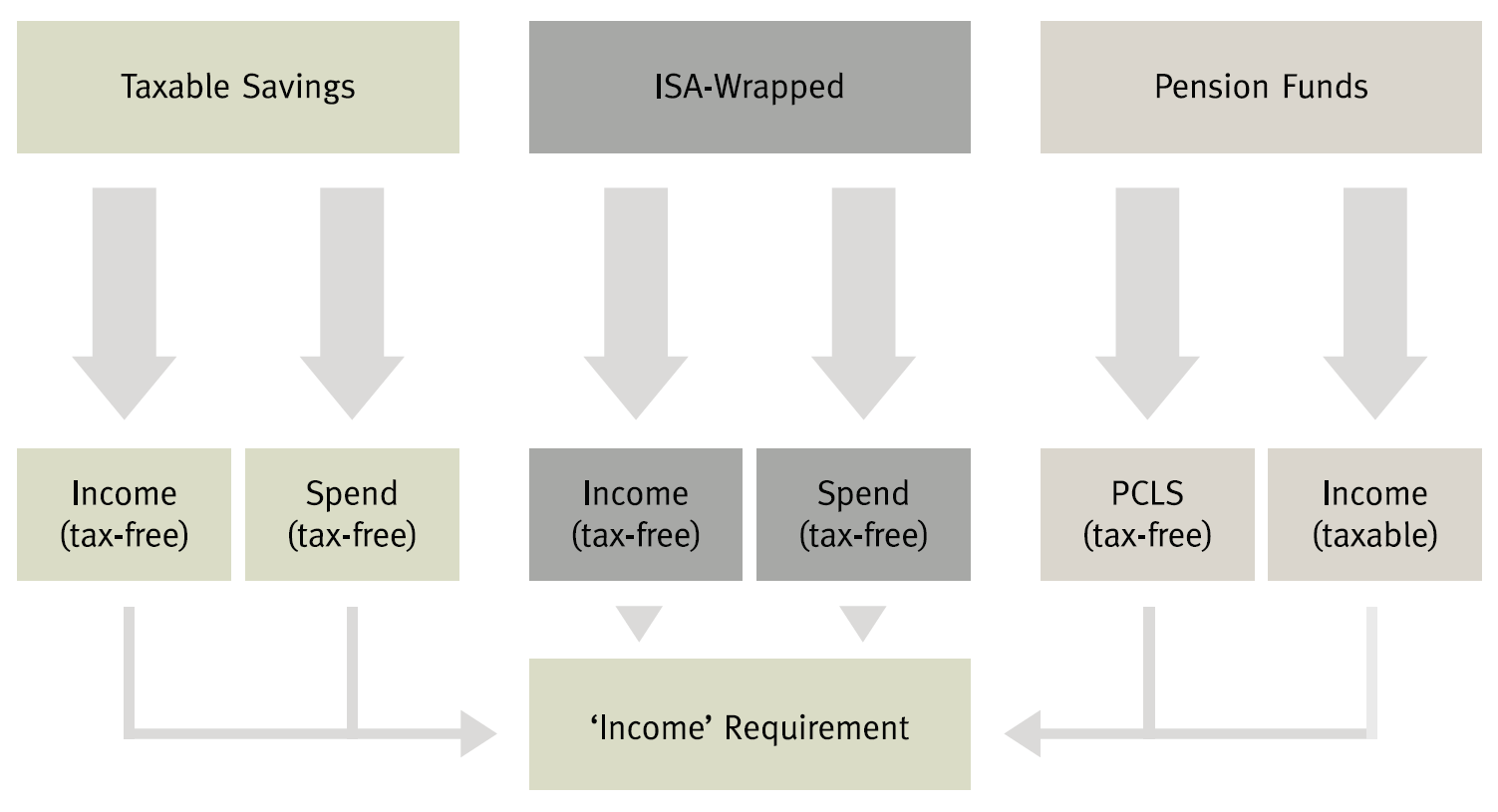

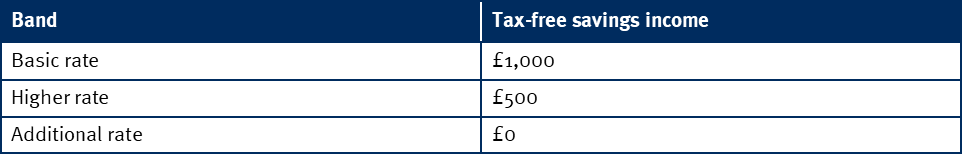

There are several ways for such high earners to retain their personal tax-free allowance of 10000 per year. This is one of the most popular tax deferral strategies for high-income earners because of higher limits that can be invested. As tax allowances are progressively withdrawn on any income over 100000 there is also a marginal effective rate of c60 that applies to any income between 100000 and 125000 regardless of where you reside in the UK.

Here are five tax saving tips that are easy to apply. You can deduct the amount you contribute to a tax-qualified retirement account from your income taxes except for Roth IR As and Roth 401 ks. 401 k or 403 b.

9 Ways for High Earners to Reduce Taxable Income 2022 1. The interest portion offers a deduction up to Rs. Stash money in your 401 k Less taxable income means less tax and 401 ks are a popular way to reduce tax bills.

Max Out Your Retirement Account. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Specifically contribute to a traditional 401 or IRA.

Deduction for securities and other appreciated assets up to 30 of AGI. Make spousal contributions to reduce your tax liability. Lets start with retirement accounts.

Its extremely difficult to get ahead in. Prepay tax-deductible expenses to bring your tax deduction forward. For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower.

The IRS doesnt tax what you. 50 Best Ways to Reduce Taxes for High Income Earners 1. If you are an employee and you have an employer-sponsored 401 k or 403 b in 2018 you can contribute up to 18500 per year of your gross income.

Employer-based accounts such as 401 k and 403 b accounts allow you. Max Out Your Retirement Contributions. Tax Tips for High Income Earners.

This training is accessible to all taxpayers regardless of whether your yearly profit are 40000 400000 or 4000000. Consider salary sacrificing to reduce your taxable income. Securities real estate other illiquid assets 3.

This increased tax burden for high earners is a deliberate policy by the Government which stated. Establish retirement accounts One of best ways for high earners to save on taxes is to establish and fund retirement accounts. 200000 separately under section 24.

Hopefully these tax-saving tips for high-income earners will help them realize the power of a home-based business. You will incur no capital gains tax on gifts of appreciated assets ie. In any case there are tax strategies for high income earners.

Delay receiving income to avoid paying tax in the current financial year. These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income. As a clear result of the governments.

In any case since tax sections influence higher income people to pay a higher rate tax rate tax arranging turns out to be considerably increasingly troublesome. There are five ways to get an income tax deduction on your home loan s. There is a five-year carry-forward for unused deductions.

One is to transfer any savings and investments that produce an income to their spouse or civil partner to bring their annual income back below 100000. If you are considered to be a high-income individual and have an adjusted income of more than 150000 per year and a threshold income of more than 110000 per year your annual allowance will be tapered. He earned a Juris Doctorate from the University of Kentucky College of Law.

Tax Strategies Savings for High-Income Families. Deduction for cash up to 60 of AGI.

Income Tax Calculator Five Quick Ways To Reduce Your Bill In 2022

Tax Free Savings Check If You Re Eligible Money Saving Expert

Best Tax Saving Tips Best Ways To Save Income Tax For Fy 2020 21 Abc Of Money

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Investing Personal Finance Budget

How Did You Save Your Tax Money This Year If You Are In A 30 Slab Quora

Top Money Paid By Clickbank And Clicksure Go To This Website Http Im 6p3qdhcw Yourreputablereviews Com Charts And Graphs Tax Return Graphing

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning

The 5 Years Before You Retire Retirement Planning When You Need It The Most Paperback Overstock Com Personal Finance Books Retirement Planning How To Plan

Year End Tax Planning For Individuals Saffery Champness

7 Roth Ira Advantages In Saving For Retirement Inside Your Ira Many Americans See A Roth Ira As A G Roth Ira Saving For Retirement Investing For Retirement

Save Income Tax Best Tips To Save On Tax 2021 22 Buztak

Best Tax Saving Tips Best Ways To Save Income Tax For Fy 2020 21 Abc Of Money

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

What Tax Do I Pay On Savings And Dividend Income Low Incomes Tax Reform Group